how much does the uk raise in taxes

A 40bn tax rise would be the equivalent of an increase of 7p on the basic rate of income tax or an increase of six per cent on VAT he said. UK tax revenues were equivalent to 33 of GDP in 2019.

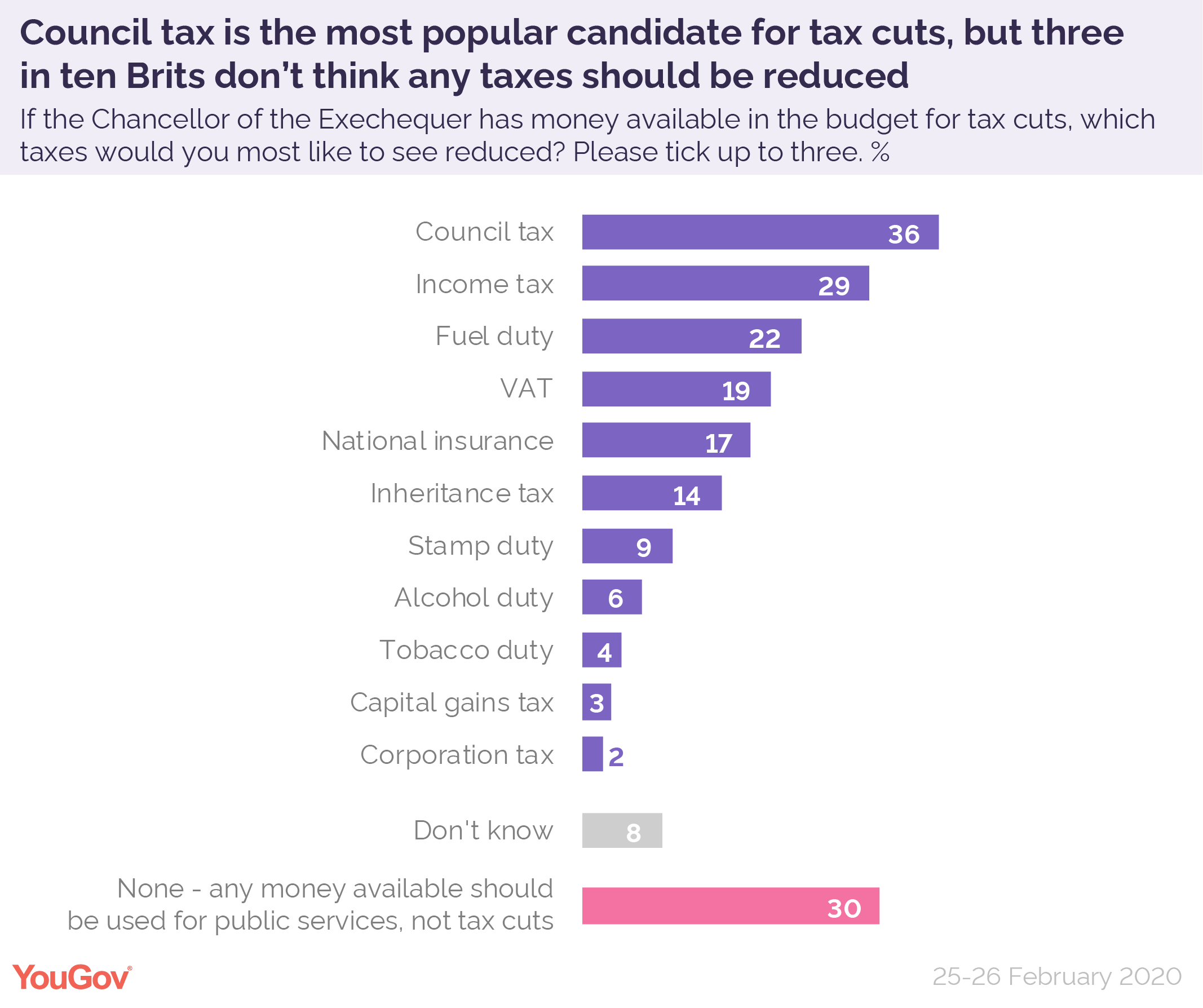

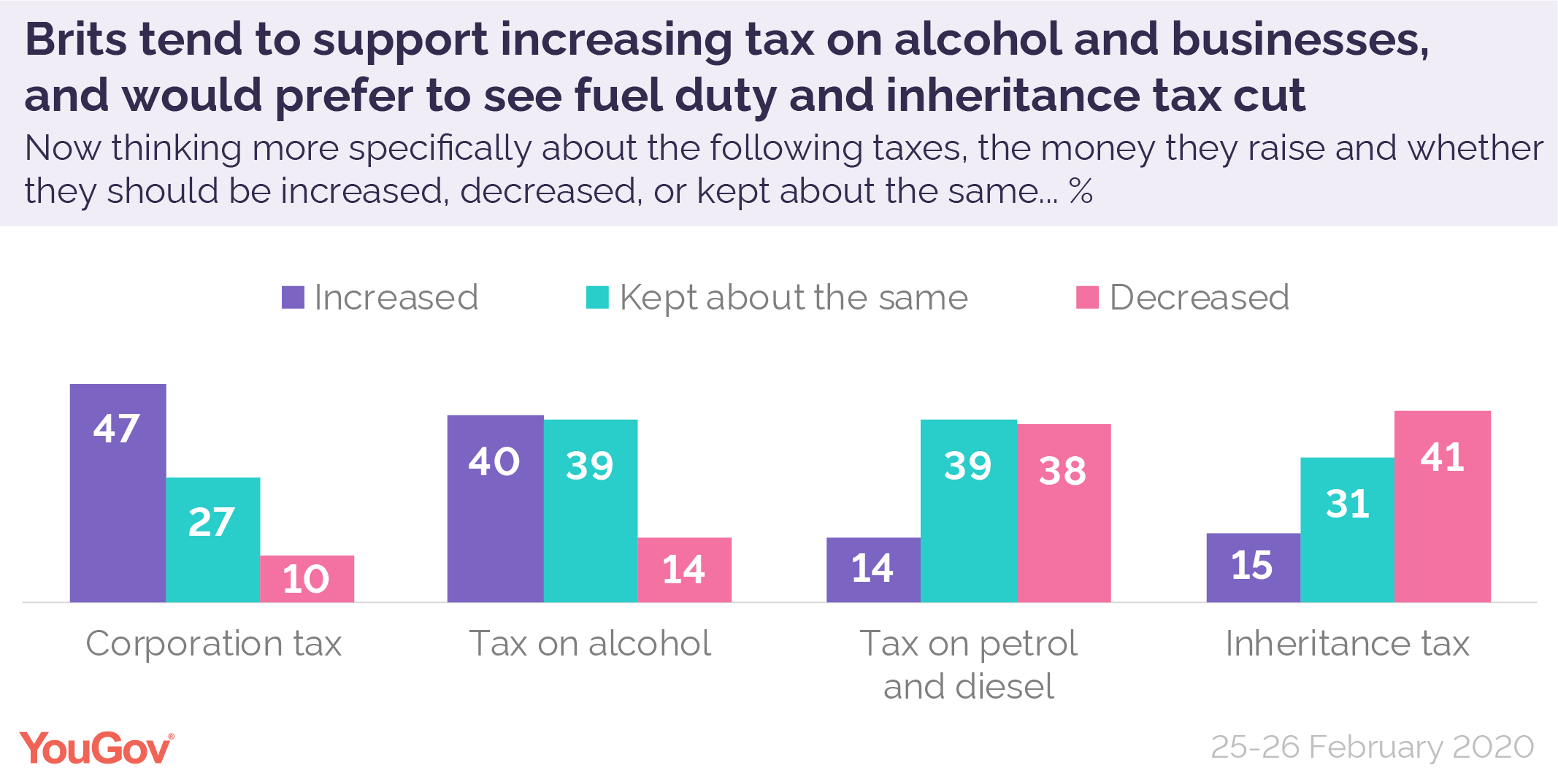

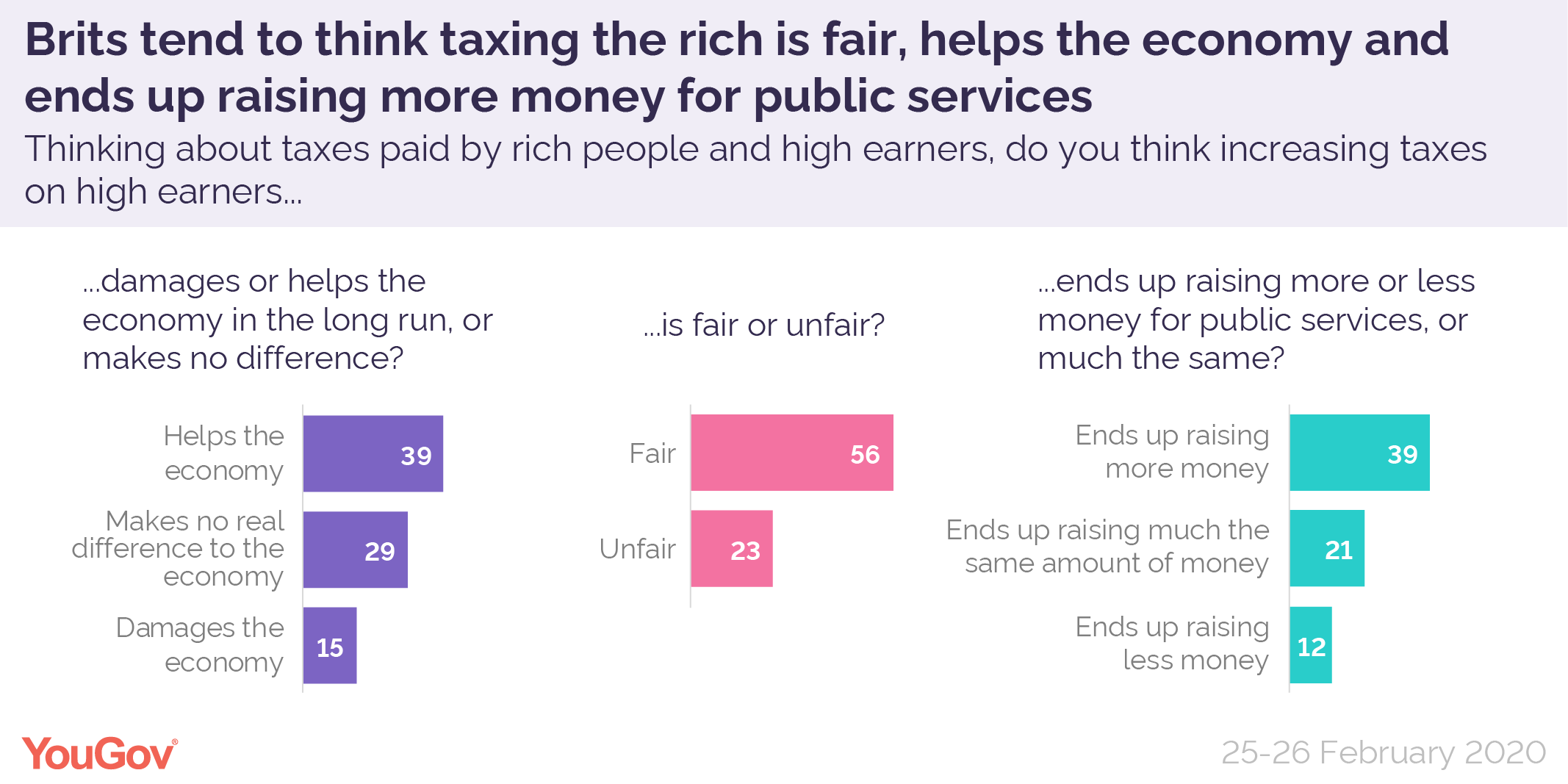

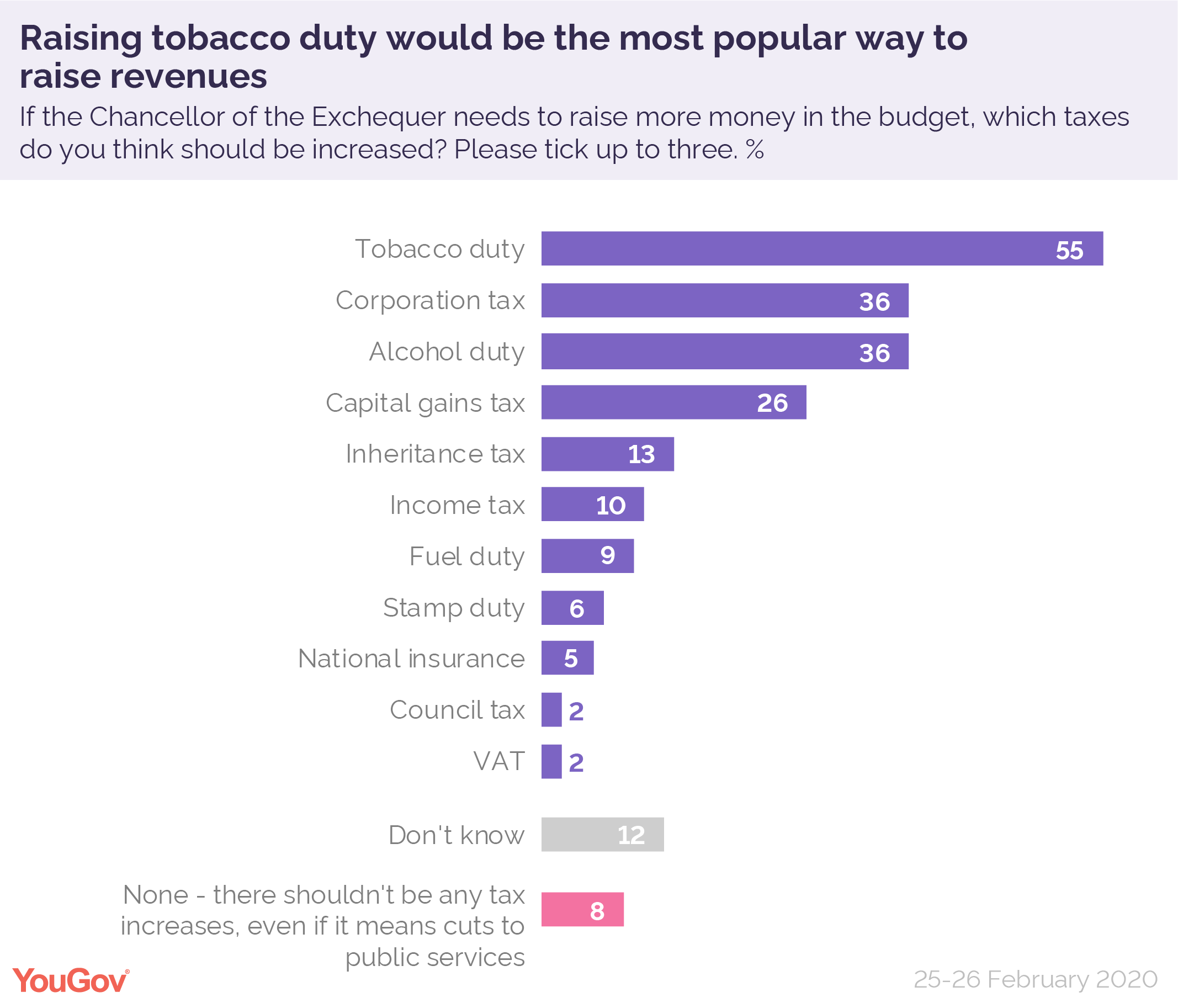

Budget 2020 What Tax Changes Would Be Popular Yougov

Within the UK income tax system there are then specific allowances for savings and dividend income.

. Income earned in excess of the basic rate limit is taxed at the higher rate 40 until an individual reaches the higher rate limit of 150000. Companies with profits between 50000 and 250000 will pay tax at the main rate reduced by a marginal relief providing a gradual increase in the effective Corporation Tax rate. - -- a 1 percentage point rise in all rates of income tax would raise 55 billion.

Much of the revenue initially. With the potential to raise 70bn a year 8 of total tax revenues taken by the government the financial benefits do add up while the criticisms of wealth taxes simply dont. The table below shows the national insurance rates for the 202223 tax year.

How much does the UK raise in tax compared to other countries. Total UK public revenue will amount to 8995 billion in 2023. The UK raised 35 of national income in tax in 201819.

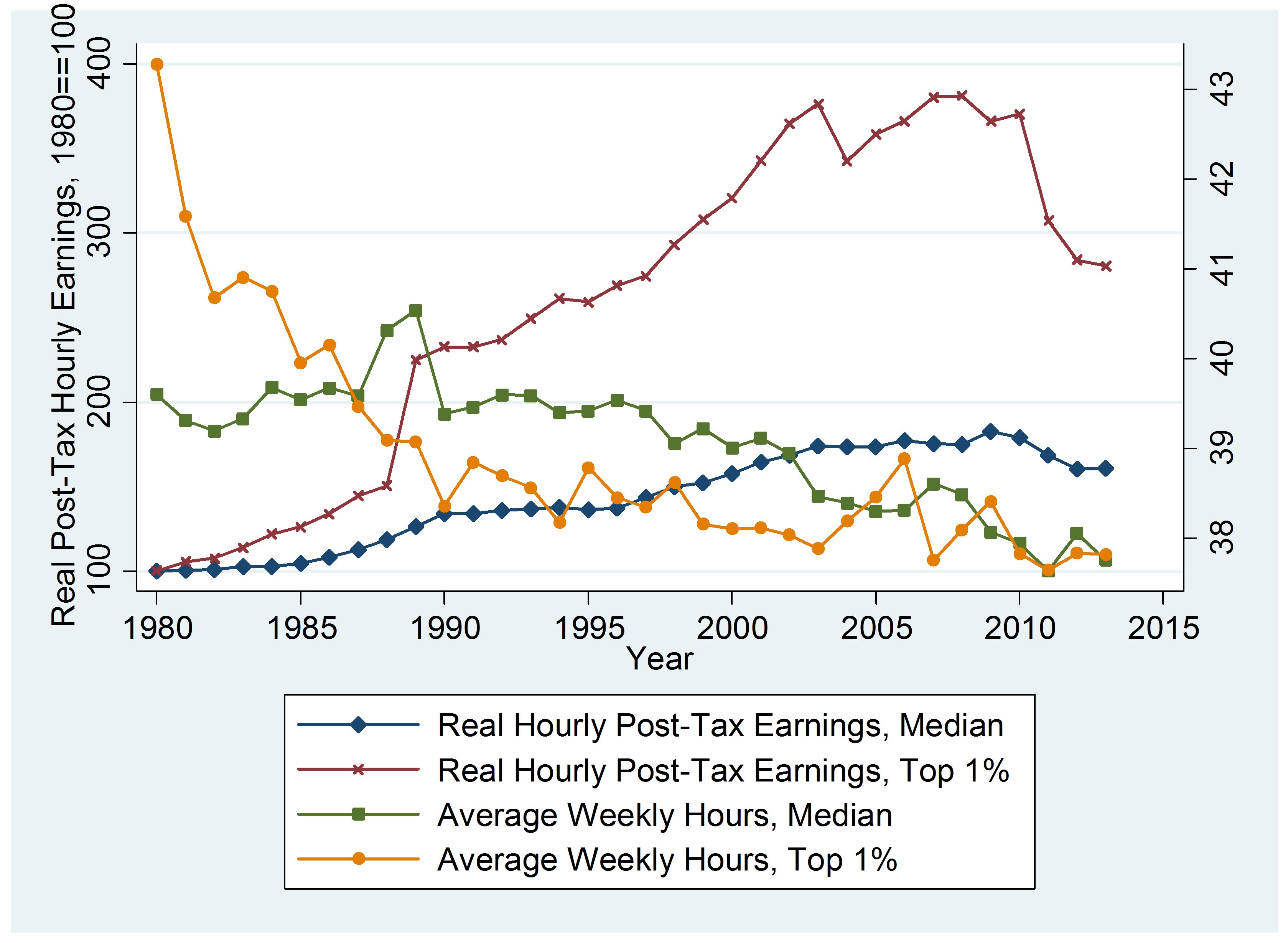

Figure 1 shows that tax as a share of national income has fluctuated between around 30 and 35 of national income since the end of the second world war and been rising since the early 1990s. - -- a 1 percentage point rise in all employee and self-employed National Insurance. This is effectively a tax rise.

An incoming government increase taxes in order to limit the scale of public spending cuts required to meet its fiscal targets. In 202122 the value of HMRC tax receipts for the United Kingdom amounted to approximately 71822 billion British pounds. Of this 39 percent will be in indirect taxes 34 percent in income taxes 18 percent in national insurance contributions and 9 percent in business and other revenue.

From 6 April 2022 Class 1 and Class 4 national insurance contributions are set to increase by 125 percentage points for anyone earning above the primary threshold of 9880. The main rate of corporation tax will increase from 19 to 25 as of April 2023 and companies that earn less than GBP 50000 per year will see their small profits rate increase from 19 to 19. Thereafter all income is taxed at the additional rate 45.

The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. A basic tax rate of 20 applies to everyone who earns between 12501 and 50000. Increasing Income Tax for only the highest rate taxpayers would raise an estimated additional 60 million next year if introduced in April 100 million the year after and 90 million the year after that.

This represented a net. This upper limit is 79 higher than it was in 20182019 46351. This is slightly below the average for both the OECD 34 and G7 36 and considerably lower than many other European countries average tax revenue among the EU14 was 39 of GDP in 2019.

But this doesnt mean that the lower tax rate has brought in 8 billion in extra revenue as experts such as tax barrister Jolyon Maugham and the Institute for Fiscal Studies have pointed out. If you make more than 50000 in 20202021 you qualify for the higher rate threshold which means that you need to pay 40 tax on any income you earn over this amount. Increase 45 additional rate of Income Tax by 1p.

The total amount of tax collected from additional rate taxpayers rose from 38 billion in 201213 to 46 billion in 201314a rise of 8 billion. Income tax bands 2020 to 2021. Up to.

That would be an extra 91000 in tax revenue per person. Of the big three taxes. Tax on share dividends will also be increased by 125 percentage points in a move expected to raise 600m.

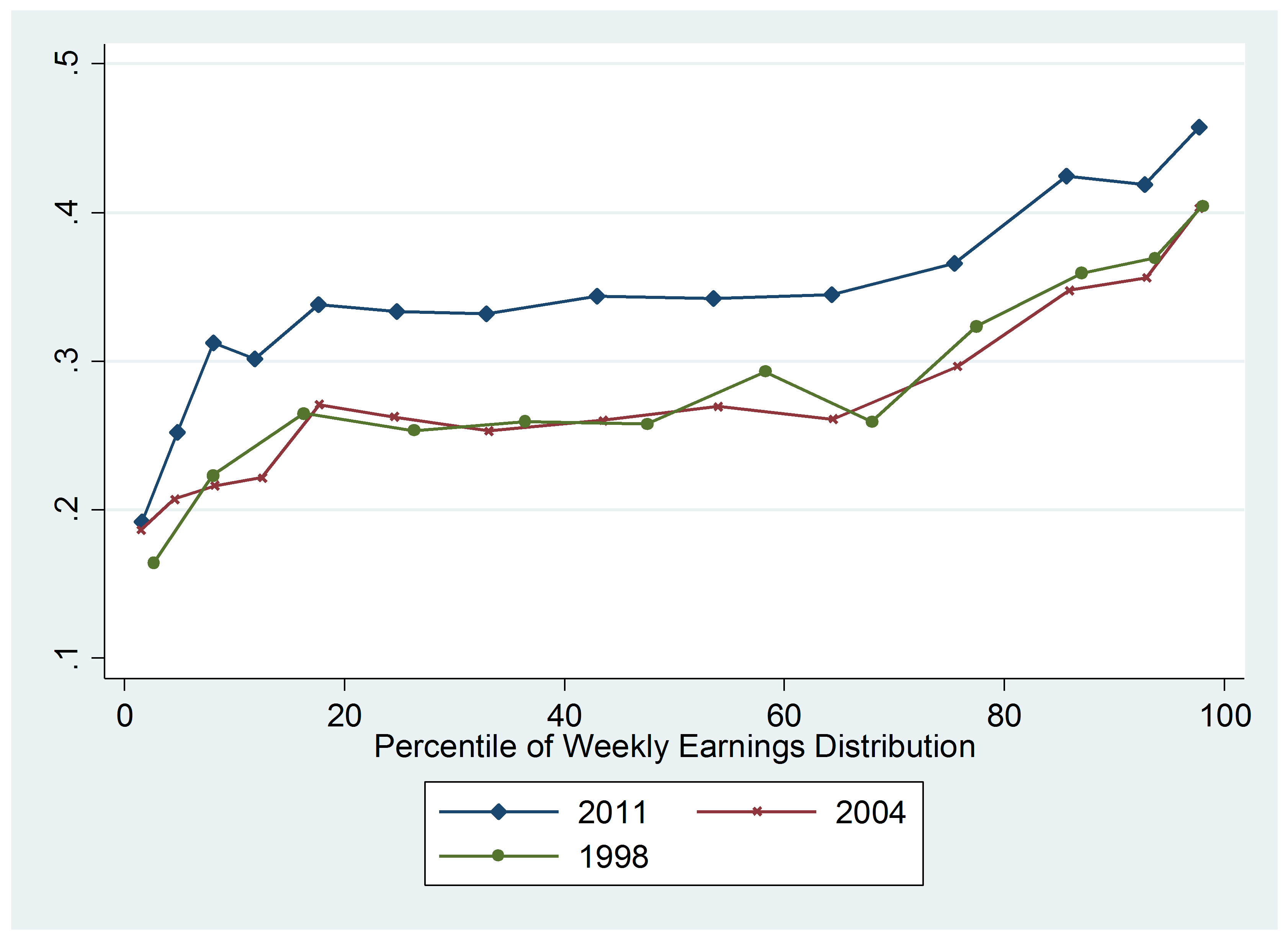

The Top Rate Of Income Tax British Politics And Policy At Lse

The Top Rate Of Income Tax British Politics And Policy At Lse

Types Of Tax In Uk Economics Help

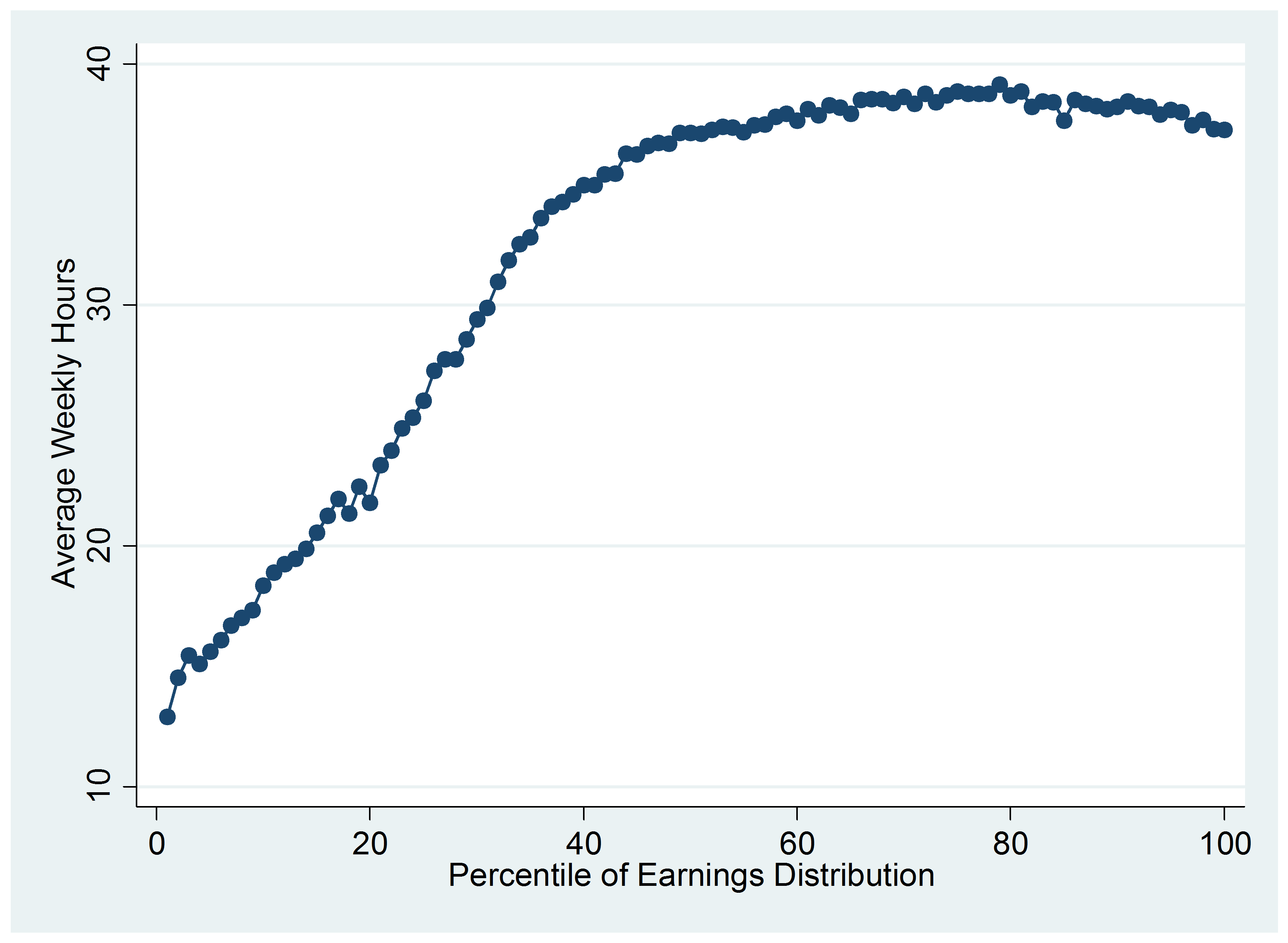

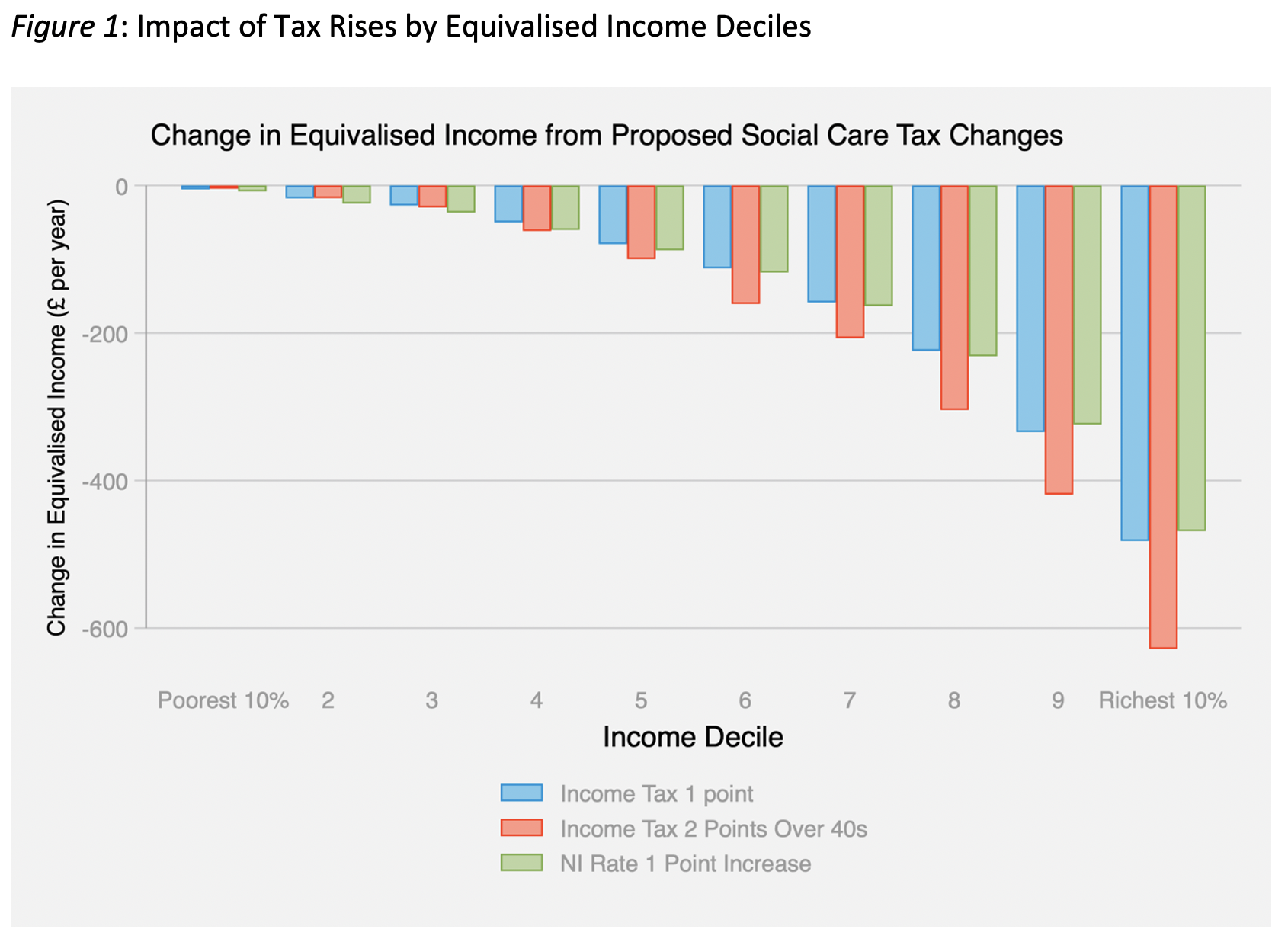

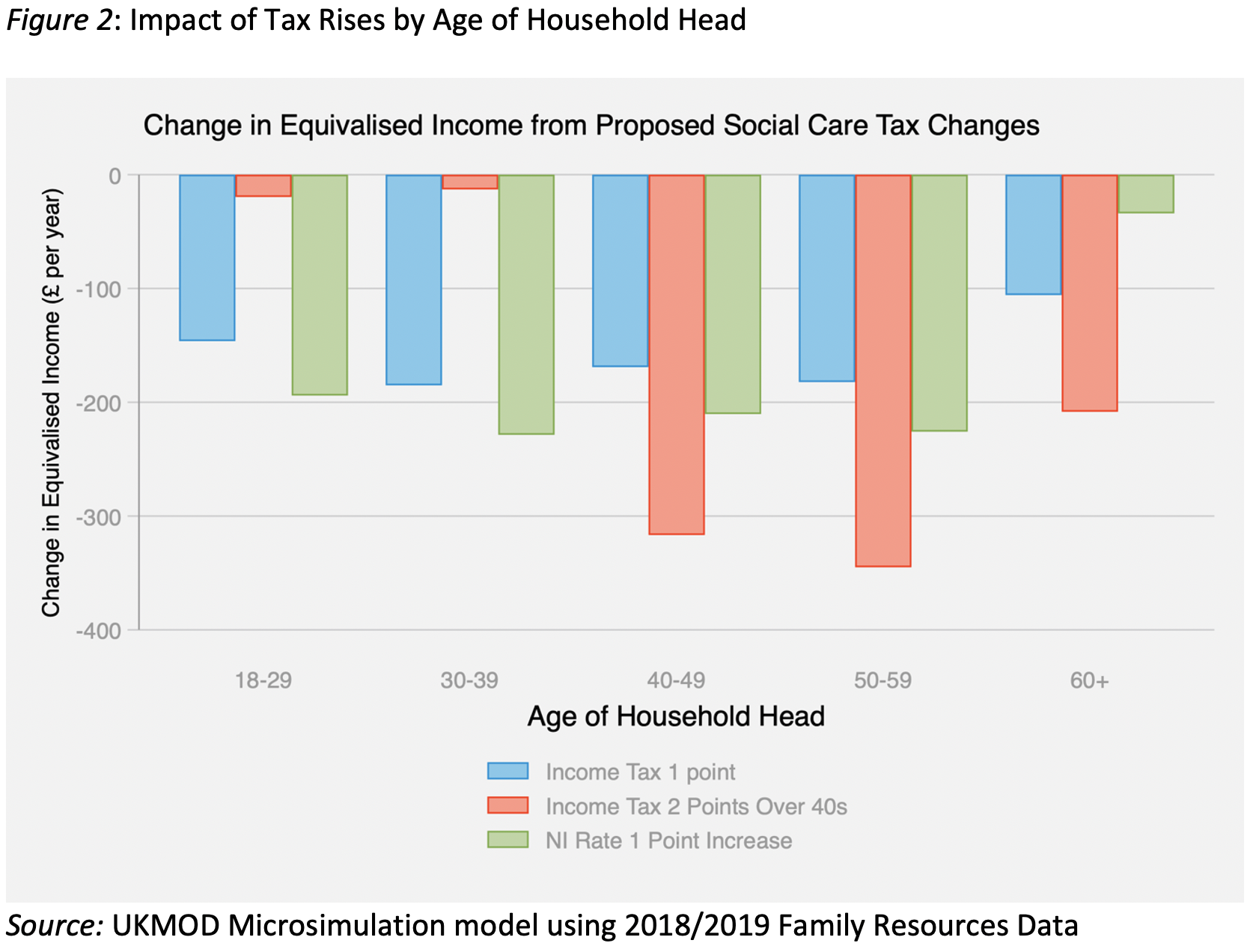

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

The Top Rate Of Income Tax British Politics And Policy At Lse

Budget 2020 What Tax Changes Would Be Popular Yougov

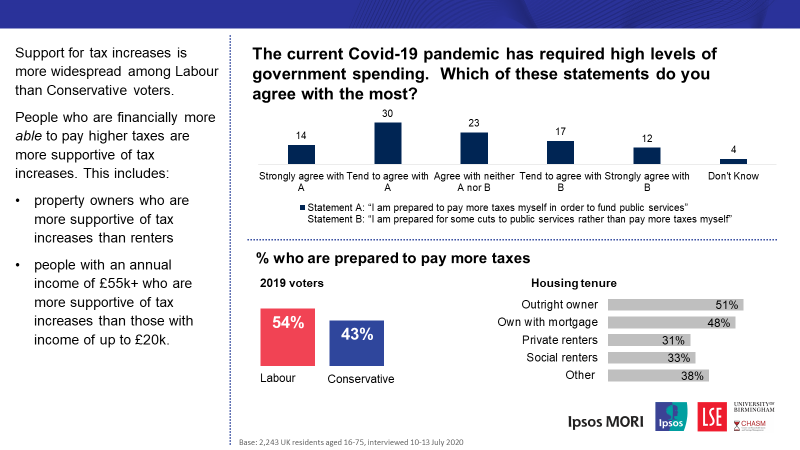

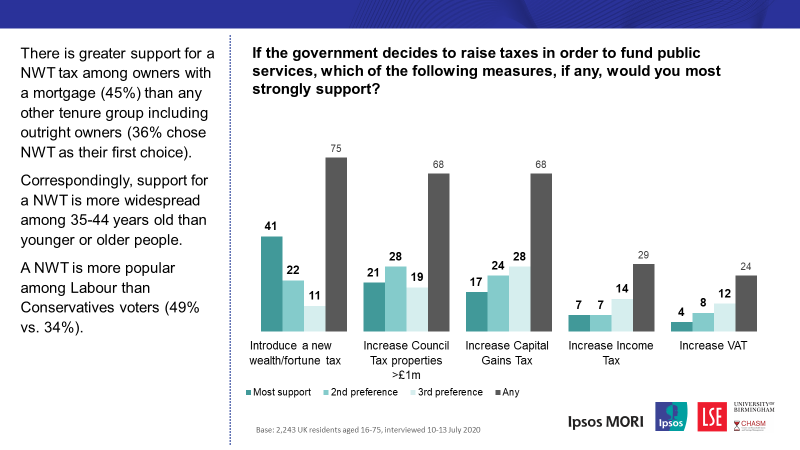

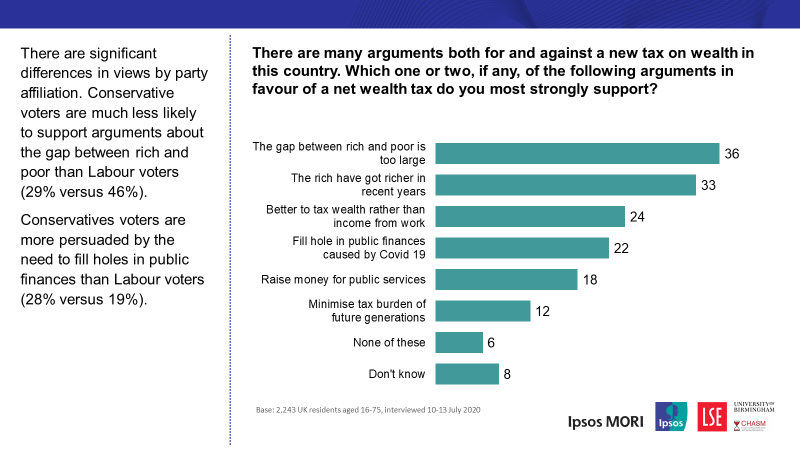

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

Budget 2020 What Tax Changes Would Be Popular Yougov

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

Are Britain S High Earners Taxed Too Much Or Too Little Tax The Guardian

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

Budget 2020 What Tax Changes Would Be Popular Yougov

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

Tax On Test Do Britons Pay More Than Most Tax The Guardian

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

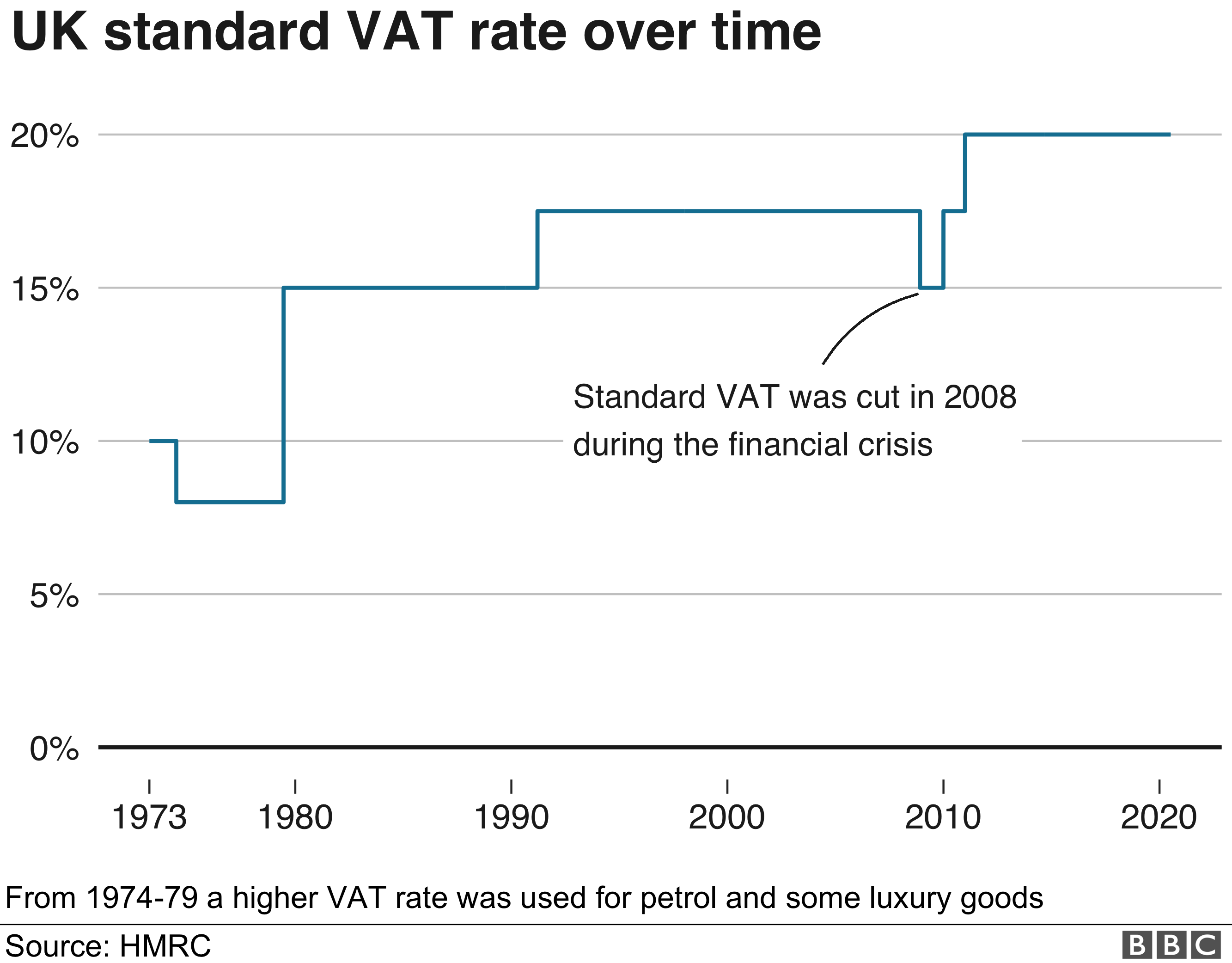

What Is Vat And How Does It Work Bbc News

Uk Government Revenue Sources 2022 Statista

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For